summit county utah sales tax rate

What is the sales tax rate in Summit County. Rates include state county and city taxes.

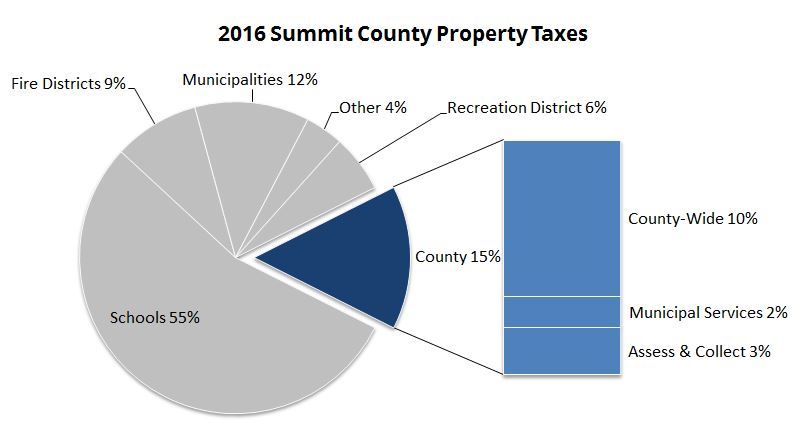

Your 2018 Summit County Utah Property Taxes Explained Park City Real Estate Agent Nancy Tallman

The median property tax in Summit County Utah is 1921 per year for a home worth the median value of 492100.

. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The 2022 Summit County Tax Sale will be held online. The Summit County Sales Tax is collected by the merchant on all qualifying sales made within.

Utah sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Cities or towns marked with an have a local city-level sales tax potentially in addition to additional local government sales taxes. The tax rate is determined by all the taxing agencies-city or county school districts and others-and depends on what is needed to provide all the services you enjoy.

The base state sales tax rate in Utah is 485. Utah has 340 cities counties and special districts that collect a local sales tax in addition to the Utah state sales tax. If you need access to a database of all Utah local.

Summit County in Utah has a tax rate of 655 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Summit County totaling 06. Any sale funds in excess of the total amount of delinquent taxes penalties interest and administrative fees will be treated as Unclaimed Property under Title 67 of the Utah Code Annotated and forwarded to the Utah State Treasurer after one year has elapsed from the date of the tax sale. The Summit County Sales Tax is collected by the merchant on all qualifying sales made within Summit County.

2022 Summit County Tax Sale Rules 1. The assessors office also keeps track of ownership changes. Due Date for 2022 taxes to avoid additional penalties interest.

Tax rates are provided by Avalara and updated monthly. The Utah state sales tax rate is currently. The Summit County Utah sales tax is 655 consisting of 470 Utah state sales tax and 185 Summit County local sales taxesThe local sales tax consists of a 135 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc.

2020 rates included for use while preparing your income tax deduction. 2022 Utah Sales Tax By County. Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800.

274 rows Washington County. Ad Find Out Sales Tax Rates For Free. Utah City and Locality Sales Taxes.

Summit county utah sales tax rate Sunday May 8 2022 Edit. The total sales tax rate in any given location can be broken down into state county city and special district rates. The 2018 United States Supreme Court decision in South Dakota v.

Utah has a 485 sales tax and Summit County collects an additional 155 so the minimum sales tax rate in Summit County is 63999 not including any city or special district taxes. What is the sales tax rate in Summit County. The minimum combined 2022 sales tax rate for Summit County Utah is.

The Summit County 2022 Tax Sale will be hosted online by Public Surplus. Groceries are exempt from the Summit County and Ohio state sales taxes. Summit County is a vital community that is renowned for its natural beauty quality of life and economic diversity that supports a healthy prosperous and culturally-diverse citizenry.

Missouri has state sales tax of 4225 and allows local governments to collect a local option sales tax of up to 5375There are a total of 730 local tax jurisdictions across the state collecting an. Utah UT Sales Tax Rates by City. 31 rows The latest sales tax rates for cities in Utah UT state.

The Summit County sales tax rate is. The Ohio state sales tax rate is currently. This is the total of state and county sales tax rates.

A student is in custody after a teacher at Summit Academy North High School in Romulus reported a suspicious package to the districts liaison officer. 2020 rates included for use while preparing your income tax deduction. This is the total of state and county sales tax rates.

Parcels are sold as-is No. Facilitating the collection of delinquent taxes due. With local taxes the total sales tax rate is between 6100 and 9050.

Utah has a 485 statewide sales tax rate but also has 131 local tax jurisdictions including cities. Received in excess of the total amount due will be treated as surplus property and forwarded to the office of the Utah State Treasurer. Utah has recent.

The state sales tax rate in Utah is 4850. Summit County collects on average 039 of a propertys assessed fair market value as property tax. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov.

Look up 2022 sales tax rates for Summit Utah and surrounding areas. Find your Utah combined state and local tax rate. Summit County UT Sales Tax Rate.

The amount of taxes you pay is determined by a tax rate applied to your propertys assessed value. This rate includes any state county city and local sales taxes. The minimum combined 2022 sales tax rate for Summit County Ohio is.

Click any locality for a full breakdown of local property taxes or visit our Utah sales tax calculator to lookup local rates by zip code. This table shows the total sales tax rates for all cities and towns in Summit. Fast Easy Tax Solutions.

You can use our Utah Sales Tax Calculator to look up sales tax rates in Utah by address zip code. The current total local sales. Local tax rates in Utah range from 0 to 4 making the sales tax range in Utah 47 to 87.

91 rows This page lists the various sales use tax rates effective throughout Utah. You can find more tax rates and allowances for Summit County and Utah in the 2022 Utah Tax Tables. The Treasurer is responsible for the banking reconciliation management and investment of all Summit County funds.

Summit County has one of the highest median property taxes in the United States and is ranked 497th of the 3143 counties in order of median property taxes. The 2018 United States Supreme Court decision in South Dakota v. Manage Summit County Funds.

The Summit County Ohio sales tax is 675 consisting of 575 Ohio state sales tax and 100 Summit County local sales taxesThe local sales tax consists of a 100 county sales tax. 1 Penalty on Unpaid Taxes. Final Deadline for 2022 Tax Relief Applications.

The Summit County sales tax rate is. UT Rates Calculator Table. Mission Provide excellent ethical efficient services that ensure quality of.

If you do not have a Utah sales tax licenseaccount report the use tax on line 31 of TC-40.

Summit County Utah Republican Party

Wasatch Summit County Property Taxes How They Work Park City Real Estate Agent Nancy Tallman

Two Bulls In Summit County Cattle Herds Test Positive For Disease State Veterinarian Says

Summit County Treasurer S Office Mails Property Tax Notices Summitdaily Com

2 Snowshoers Dog Killed By Saturday Avalanche In Summit County

National Level Real Estate Forecast Real Estate Real Estate Information Real Estate Prices

Summit County Adds Jobs In March But Unemployment Rate Not Fully Recovered From Pandemic

Suspect Evades Police Enters Home Where Family Was Sleeping

Skyrocketing Home Values In Summit County Mean Higher Property Taxes For Some Parkrecord Com

Your 2018 Summit County Utah Property Taxes Explained Park City Real Estate Agent Nancy Tallman

Summit County Sales Tax Revenues Show Continued Economic Comeback In Wake Of Covid Parkrecord Com

Colorado Summit County Tourism Industries Face Long Hard Road To Recovery Summitdaily Com

News Flash Summit County Co Civicengage

How Healthy Is Summit County Utah Us News Healthiest Communities

2022 Best Places To Live In Summit County Ut Niche

Summit County Has The Highest Life Expectancy In The Nation According To New Study Summitdaily Com

Summit County Can T Lower Property Taxes For Owners Who Rent Long Term To Locals Summitdaily Com